Life Insurance You May Not Know About Defined-benefit Pension Plan In-Service Death Benefits

If you participate in a defined benefit pension plan it can dramatically reduce the amount of life insurance you need.

Few employers sponsor this type of pension plans these days, however they are still typical for government employees, military, school systems, utilities, and some large employers like IBM, UPS, Lockheed Martin, et al. DB plans remove classic retirement challenges like stock market volatility or living too long. but they require decisions of their own, such as which survivorship option to elect or should I buy back years if eligible?

I once helped a school administrator, under the Teachers Retirement System of Georgia, make some decisions at his retirement: which survivorship election to make and what to do with his voluntary term life insurance. He had worked for the school system over 30 years, and the formula for his pension was number of years of service, times 2%, times highest salary in the last two years which is typically the final salary. Most DB pensions have a similar formula. He didn’t elect a survivorship benefit, because he was in good health, had significant assets, and most importantly his wife was a schoolteacher with over 30 years of service and entitled to her own pension. This gave him the highest lifetime income.

He had carried voluntary term life insurance by payroll deduction most of his career, which ended at retirement. and wanted to know what to do about it. Premiums were no small amount, about $200/month. It started out cheap and convenient: just check the box and its payroll deducted. The danger of payroll deduction is out of sight out of mind. He’d elected five times salary, and as his salary and age crept us, his premiums followed.

As we probed into the details of his pension, it became clear that had he died since the time he had been vested (after 10 years of service or for the last 20 years!) his named beneficiary would have received a lifetime income. This is an “in-service death benefit”– the benefit paid to the employee’s beneficiary if the employee dies during their working career, after they are vested but before they retire.

This man had a high salary and great number of years of service, so his survivorship benefit was equivalent to a substantial amount of essentially hidden life insurance, well over $1 million. In other words, it would take $1 million invested at 5% to generate the lifetime monthly income his beneficiary had been entitled to.

Let’s consider a teacher making $40,000/year working for 15 years. If they died, 30% of their salary (2 X number of years of service) or $1,000/month would go to their beneficiary for life. How much life insurance does it take to generate this much income? $250,000 of life insurance, invested at 5%, yields about $1000/month. In other words, this in-service death benefit is like owning a $250,000 life insurance policy.

It stands to reason that such a benefit would exist, for the employer pre-funds the DB pension over many years which creates a value which doesn’t disappear in event of the participant’s early death. The more popular 401(k) pension plan balance simply goes to the named beneficiary in a lump sum, while the in-service death benefit goes to the DB beneficiary.

Most participants in defined-benefit pension plans are unaware of this. Adding insult to injury, many sign up for voluntary term insurance which ends at retirement, and it only duplicates the in-service death benefit under the pension. That premium could be accelerating the mortgage or funding a Roth for a definite future benefit, instead of renting term insurance expiring at retirement.

The point is simply that if you participate in such a plan, call human resources and see what income your beneficiary is entitled to should you die before retirement. Translate this into the amount of life insurance it takes to generate this income and it should reduce the amount of life insurance you carry.

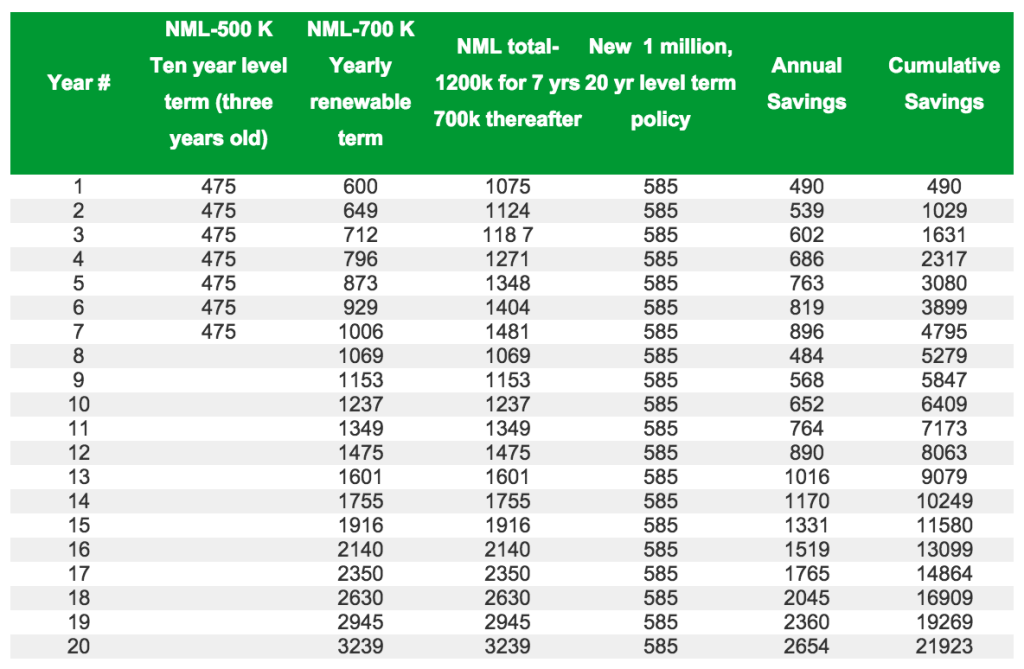

When you call HR also find out the rate schedule for your voluntary term policy’s future years so you can compare it to a level premium term policy. Employer sponsored voluntary term is usually not a good buy for a healthy person. It’s often offered on a guaranteed issue basis with no or minimum underwriting required. An individually underwritten policy requires a physical, blood work, etc., while the group term does not (guarantee issue; “just check the box”), so its rates are higher.

Lastly, rates for term through work usually increase every five years, versus 10, 15, or 20 for a personal policy.

Don’t bog down in comparing rates until you first fine tune the amount of coverage considering the hidden life insurance from in-service death benefits and other assets. “There’s nothing more wasteful than doing efficiently that which shouldn’t be done at all”, says Peter Drucker.