Before considering what type of life insurance to buy (term or cash value) or where to get a good buy, you need to choose an amount. This depends on your unique financial picture and you will not get your best answer using a rule of thumb such as “you need ten times your annual income”. Individual circumstances vary greatly. Even among life insurance professionals, you’ll find a range of recommendations for the same family situation.

While life insurance is an important element in providing protection for one’s family, its cost is just one of many competing needs. Most people’s discretionary money (what’s left after taxes, tithe, housing, auto, groceries, etc.) is pretty limited. But the ways to spend it for the family’s welfare are unlimited: building emergency funds, reducing debt, saving for the next car, children’s education, and of course a host of different insurances (like life, health, disability, and homeowners).

The Scripture commonly used to promote insurance is I Timothy 5:8.2 But that must be balanced with other Scriptural instructions that would suggest using one’s income for other purposes such as paying off debt,J building a savings reserve,4 or investing for your children’s future.s It’s easy to overly focus on the insurance decision to the neglect of the others. Is it better stewardship to spend on life insurance premiums what could go, say, into the children’s Education IRAs? I counsel my clients to take a balanced view–don’t over plan for dying and under plan for living.

Here are a few reasonable guidelines that you can adjust to your comfort level.

- Establish basic objectives such as leaving a paid-for home, no debts, an emergency fund, and income for basic living expenses.

- Don’t assume a widow (and children) will remain exclusively dependent on resources left by the husband. Consider I Timothy 5:11,14 where Paul specifically commands the church to not support younger widows because he expects them to

remarry. In fact, statistics confirm that younger widows usually remarry. In my experience, some widows remarried after a few years, some obtained good-paying jobs, and many have benefited from life insurance. - Distinguish between present life-style and insured life-style. The large house (with its higher taxes, utilities, and upkeep) of a high-income family may not be prudent for a widow without that higher income. Ask if mom and the kids would ultimately move if dad died. If the wife moves back to her hometown near her parents, what are housing costs there? Trading down to a smaller house should release some of the equity in the home, which is itself a form of life insurance.

- Ask “How well am I insured already?” Consider assets such as life insurance through your employer, Social Security, savings, retirement funds, and the surviving spouse’s income potential. Retirement accounts such as a 401(k) or IRA are available to beneficiaries at death without the 10% early withdrawal penalty.

Determine the adequacy of these assets to retire the mortgage on a suitable house, pay for the funeral and other debts, and to establish a larger than normal emergency fund (one adequate to even update an auto if needed). If assets are inadequate for achieving your basic objectives, you can then supplement them with an insurance policy.

Once the insurance proceeds remove the debt and stabilize the family’s finances, Social Security survivorship benefits pay a monthly income that’s often adequate until the kids are through high school. Remember that the family without the hemorrhage of debt payments (and with one less person to feed, clothe, transport, etc.) needs less income. A modest income will pay for groceries, clothing, and utilities.

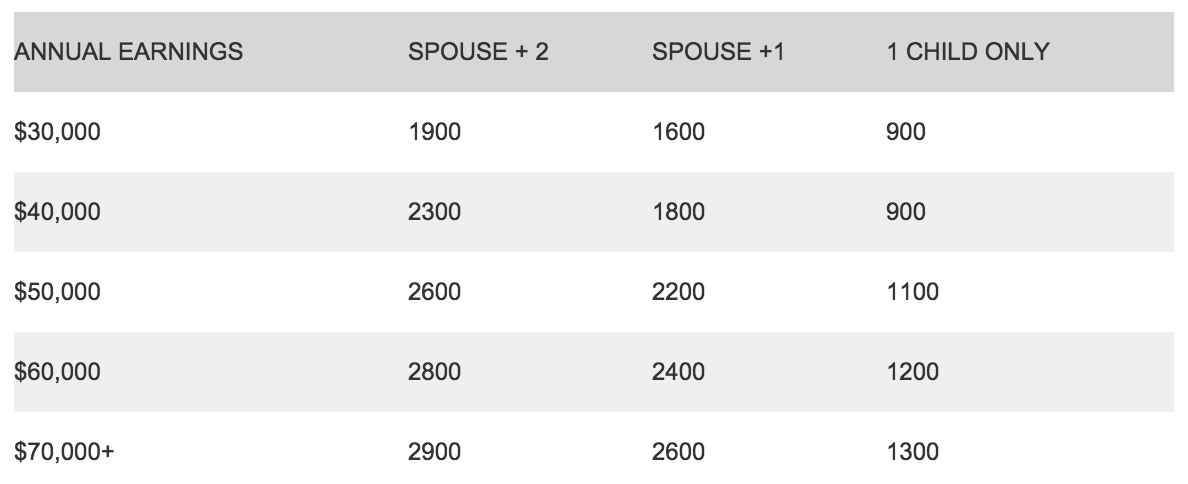

Social Security survivor benefits make Americans among the best-insured people in the world. For a family to qualify, the person who dies must (1) have paid into Social Security for six of the last thirteen quarters and, (2) have surviving children under age 18. Depending on the earnings of the deceased and the number and ages of survivors, these benefits can easily exceed $250,000. These are approximations of the monthly income a family might expect.

To better estimate your expected benefit, use the calculators at http://www.ssa.gov/planners/calculators.htm. Also, the Social Security Administration sends annual statements citing approximate benefits.

It may be best for widows to not work, or to work only part-time, since they would be filling the role of both parents. Under certain conditions, their survivor benefits are reduced by 50¢ for each $1 of earnings over $12,000 per year. Bear in mind Social Security provides nothing for a wife without children under age eighteen until she reaches age 60. Because of the concern surrounding the long-term solvency of Social Security, some are reluctant to count on survivor’s benefits. But that aspect of Social Security is actuarially sound because few dads die with young children. Also, it makes sense to let Social Security carry part of the load. After all, a majority of families pay more in FICA taxes (part of which pays for survivor’s benefits) than they do in federal income taxes. We can redeem this sizable confiscation by letting it partially reduce other personal outlays, like life insurance premiums. If we fail to build upon this Social Security benefit which we’re being forced to fund, we only hurt ourselves.