Collecting Multiple Life Insurance Policies

Leads to Redundancy and Waste

Do you own several life insurance policies? People tend to buy policies piecemeal in response to life events like the birth of a child or an agent’s sales pitch. Collecting life insurance policies is often uncoordinated and inefficient. Just having multiple policies, each with an annual policy fee, and missing volume discounts of larger policies is costly. How do I know if I have too much life insurance and am wasting resources?

Most consumers think this way:

• My agent recommended it; it seems reasonable.

• We are expecting our first child! It seems time to buy.

A proactive consumer thinks this way:

• I’ll get objective opinion from someone who does not sell policies.

• I’ll engage someone familiar with the entire insurance market, rather than primarily representing one company.

• I won’t allow my worst recallable memory to become my baseline (e.g. an uncle who died young), but I’ll think in terms of probabilities.

• I’ll consider the opportunity cost of premiums if invested elsewhere.

Case Studies: The Pastor and the Doctor

I just finished two cases, one for a 65-year-old doctor with no dependent children and the other for a 32-year-old pastor expecting their first child. Despite having good companies (USAA, State Farm, and Northwestern Mutual), they both improved a lot. Insurance consumers can profit from a gatekeeper. Instead, most rock along leaking significant resources month after month, year after year, unaware of how much they could save.

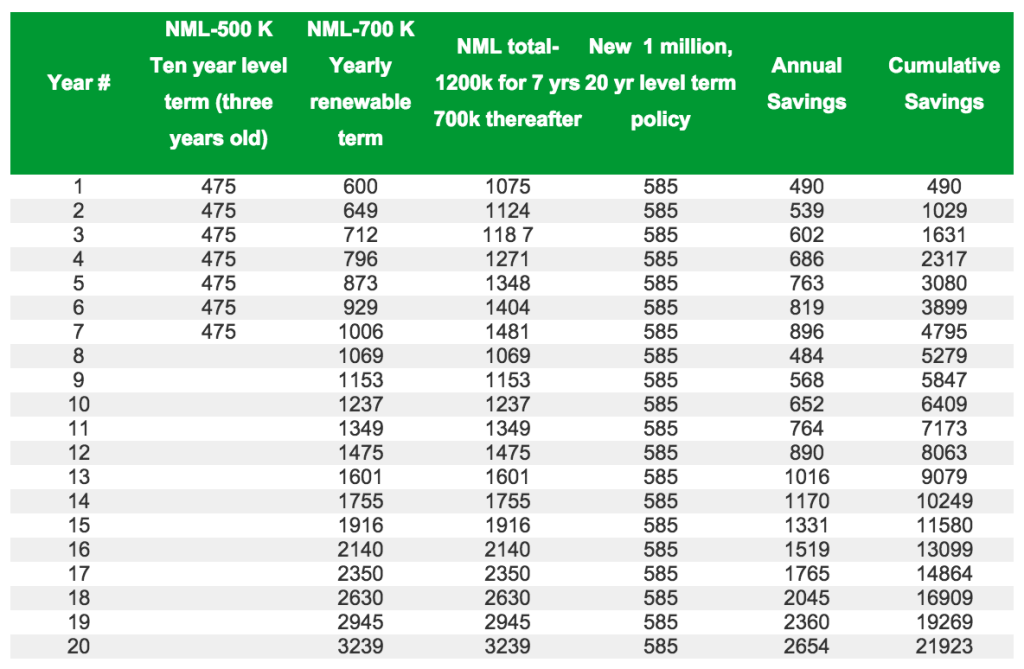

The young pastor had a $100,000 20-year level premium State Farm policy that was 8 years old (12 years left of level premiums) costing $24/month (not a good buy), a 100k term life policy provided by his church, and had just been sold a $750k Northwestern term policy.

I directed him to socialsecurity.gov/myaccount to see what survivorship benefits his child and wife would get at his death: about $2400/month. He was ignorant of this, which is a shame that something so relevant to an insurance purchaser is rarely addressed by an agent. Social security survivorship benefits for him are essentially equivalent to a $500,000 term policy.

He replaced the State Farm’s 100k and NML’s 750k term, with a 500k personal policy. 500k with the 100k through work buys a nice house near family, a 100k education fund, and a 100k emergency fund. With no mortgage and liberal savings to replace a car, etc., Social Security will pay the bills. She’s a teacher who could work once their child is school age.

We talked about the low probability of death within 20 years, which makes for better choices than a fear-inducing (What if…?) sale’s pitch. This improbability translates into a high probability of “wasting” those premiums. We considered the opportunity cost compared to putting more of it into a Roth or accelerating the mortgage. The insurance amount respects the wife’s emotional temperament.

The Northwestern term cost $407 first year, growing to $1200/yr by the 20th year. The new policy costs $316/yr guaranteed level for 20 years. He dropped the State Farm and Northwestern, the doctor dropped the USAA, big name companies that are strong in property and casualty and cash value policies, but not term insurance.

The Potential Savings

This 32-year old initially saves $32/month, which may not seem like much. However, in a Roth using a Sector strategy, it could grow to $25,000 by their baby’s first college year, or over $1 million in 50 years, his normal life expectancy. Rather than buying excessive insurance paying only in the unlikely event of death within 20 years, savings are redirected towards life events that normally occur.

The doctor had collected a hodge-podge of life policies over his career. We started with an income goal for his wife and saw he was over insured. I evaluated each policy (NML and USAA cash value and AMA term), and he began dropping the poorest and keeping the best. This will save $400/month from the first three, plus more from the one Northwestern he kept but modified. His health is good.

I guarantee clients save my fee back within 18 months, a 60+% return. This doctor saves it back in less than three months. Please see Testimonials. I’ll give an initial interview free. Call me at 706-722-5665, or email to talk about your situation.