Balance Your Tires; Sharpen Your Ax

My father, Dewey Cave, (1925-2007) was age five when the Great Depression began and age 16 when Pearl Harbor was bombed. His developmental years were spent working hard in a no nonsense environment (war), and one of his core values was keeping things at peak efficiency and battle ready. His tools were sharp, well-oiled and tuned, and one fetish he had was keeping his tires balanced. He loved a smooth ride.

There was only one shop that could acceptably do the job for him: Eubanks Tire and Alignment. This was not a franchise shop hiring recent tech school grads, but a locally owned shop with third generation artisans who balanced tires while still on the car (in case of wheel irregularity), could shave tires if out of round, and took exceptional pride in their work. You drove away smooth as glass.

A life insurance checkup is like getting your tires balanced and aligned. Not only does it extend tire wear and help the front end last longer, it makes the ride enjoyable too!

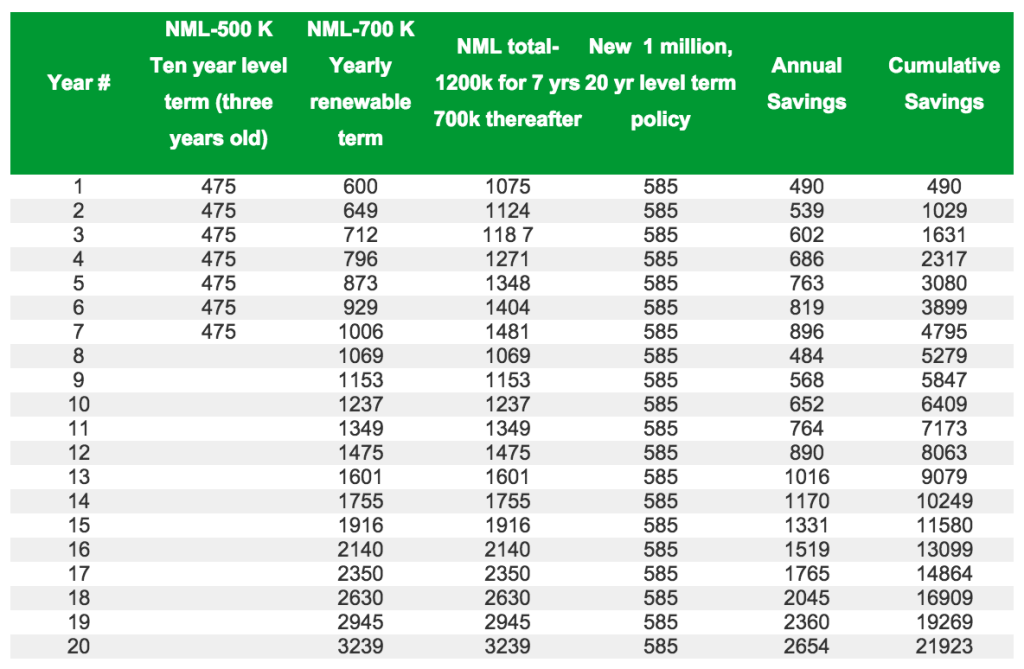

95% of people’s life insurance arrangements are out of balance and misaligned. Most policyholders don’t recognize it because it’s asymptomatic- not pulling to the side or vibrating the front end. Still after it’s fixed, the improvement is dramatic.

Abraham Lincoln said, “If I had eight hours to chop down a tree, I’d spend six sharpening my ax.” Solomon elaborates: “If the axe is dull and he does not sharpen its edge, then he must exert more strength.” Eccl. 10:10 It’s the same principle.

Tires can get worse. Yesterday an adult daughter stopped in for a visit. As I walked her to her car I noticed that a tire looked low. The tire gauge confirmed only 10 pounds of pressure. “I just put air in that tire last week”, she remarked about the first car she’s ever owned. A quick look showed an embedded nail with a slow leak. Most insurance consumers are like my daughter: have a slow leak, don’t recognize it, just keep adding air (premiums).

Is it time for you to balance and align your tires, or at least remove the nails? Those that take the time to “balance their tires” with an insurance checkup save a lot of money and enjoy a smooth ride. But you must be like my father: find a shop with skills learned over multiple generations and make adjustments.

That’s our purpose: a specialty shop with 50+ years experience (two generations) that doesn’t sell policies, to guarantee objectivity and clear vision. When you drive out of our shop, you should have the smoothest ride possible- the right amount, the best value the marketplace offers.

It’s better to call and not need it, than need it and not call. I’ll talk to anyone about their situation for 10-15 minutes without charge…or you can just keeping adding air.